Are you tired of renting or watching house prices sky rocket year over year?

WORRIED you may NEVER be able to get into the market while you wait for your credit to improve, pay down DEBTS or BUILD up a BIGGER down payment?

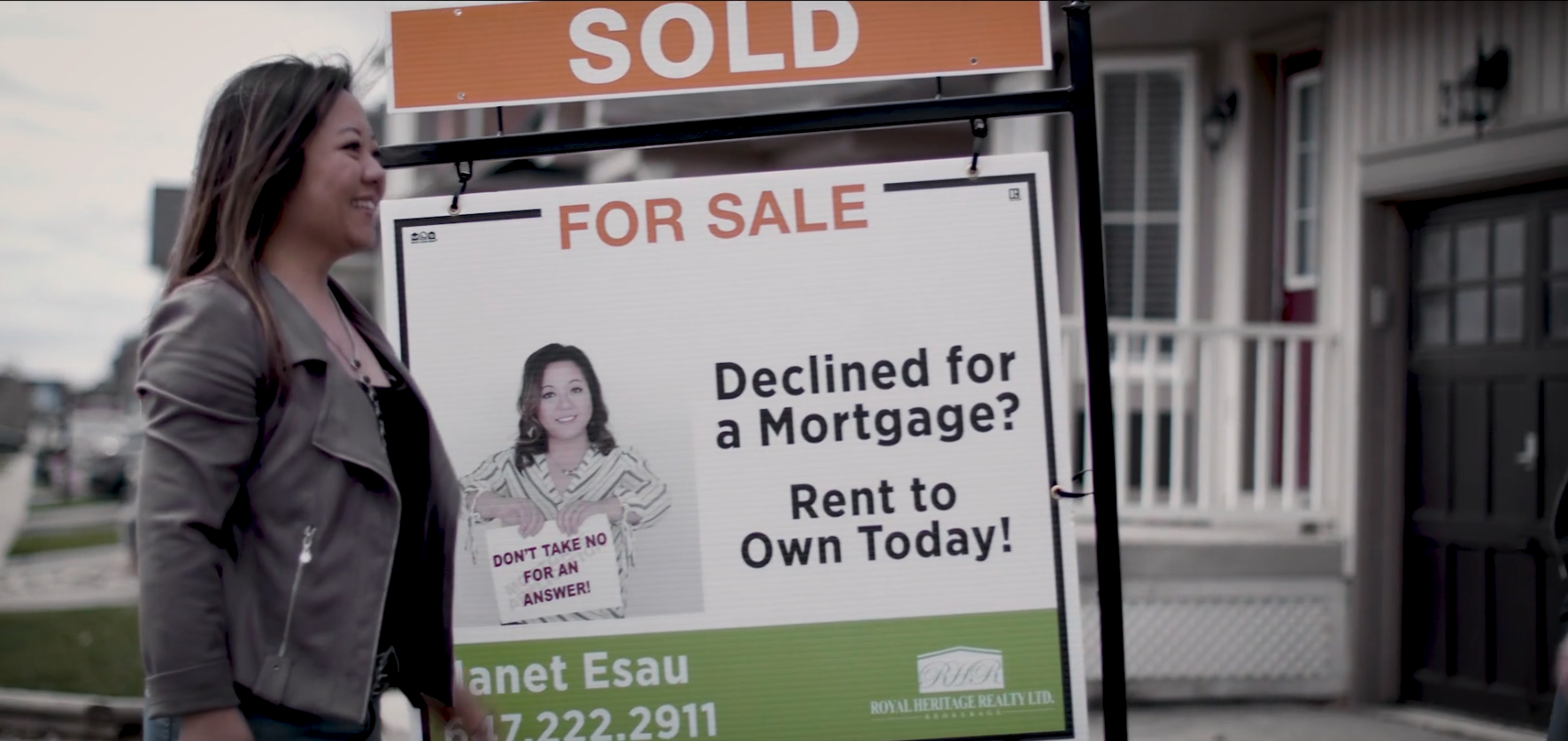

Don’t let the unknown keep you on the housing sidelines. Complete the form below if you want to find out how you can take ADVANTAGE of RENT-TO-OWN today to get in to YOUR OWN HOME sooner!

What is the deal with the market anyways?

You’re not alone if you are scratching your head at the way the house prices are shooting up and wondering if you might have missed the chance to own your own home. There is LIKELY still time in a Rent-to-Own but I think you wait until you can get a mortgage, it might be too late – ESPECIALLY if house prices increase by ANOTHER 10-15% this year. START putting your rent to work. Instead of paying down someone’s mortgage, start building YOUR OWN equity instead.

It’s always better to put 10-15% equity in YOUR pocket instead of paying that to purchase a home in a one, two or three years. Find out how.

Bubble? Prices coming down? Two words. Supply and demand. As long as we have low supply and high demand, prices will continue to increase as buyers put pressure on the market. Imagine where house prices might be in 2023 or 2024. Talk to us.

What is in store for renters?

If you want to OWN your OWN home and are tired of paying $24,000 OR MORE to someone else’ mortgage, this information is for YOU:

Rent is expected to increase 11% in 2022 on new rentals

It is being predicted that more Landlords will sell in 2022 to capitalize on the high prices and to avoid restrictions being placed on them by the Government.

The above will displace many renters who will be forced to find a new place to live and likely pay much higher rents than they are used to. Lots of instability among renters.

Is Rent-to-Own a fit for your family situation?

Rent-to-Own can help families in many situations. We provide a flexible program that can support you to reach your goal of homeownership at the end of the Rent-to-Own term. Do you fit any of the buckets below?

Self-employed

New to the country

Tired of giving someone else $24,000 a year or more to pay down their house

Have gone through credit challenges which impacted your credit history? Collections? Consumer Proposal? Bankruptcy or late payments?

Have some savings but not enough downpayment to get a traditional mortgage

Navigate Rent-to-Own Smoothly

At Clover Properties, we have created a program that has a success rate over 90%. We provide flexible solutions that can work for many families that want the opportunity to own their own home and with it, build equity that can help the financial health of their family into the future. Besides our 12 years of experience, we have also written the book on Rent-to-Own. We have taken years of experience and research and instilled it into the Rent to Own Essential Guide for Homebuyers. This is a resource that Canadians like you can trust.

Our goal is to provide you with QUALITY, FACTUAL and RELEVANT information so that you can become a homeowner as quickly and efficiently as you can.

Clover Properties – Get to Know Us

Clover Properties is strongly committed to helping Canadian homebuyers realize their homeownership dreams.

We believe that Canadian banks and the mortgage industry have not kept up with the changing times to support credit-challenged home buyers. But we are here to make it possible for families to become homeowners through our Assisted Purchase Program. We’ve been helping families get on the path to homeownership since 2009, and we may be able to help you too.

Copyright 2009 -2021 Clover Properties. All Rights Reserved.