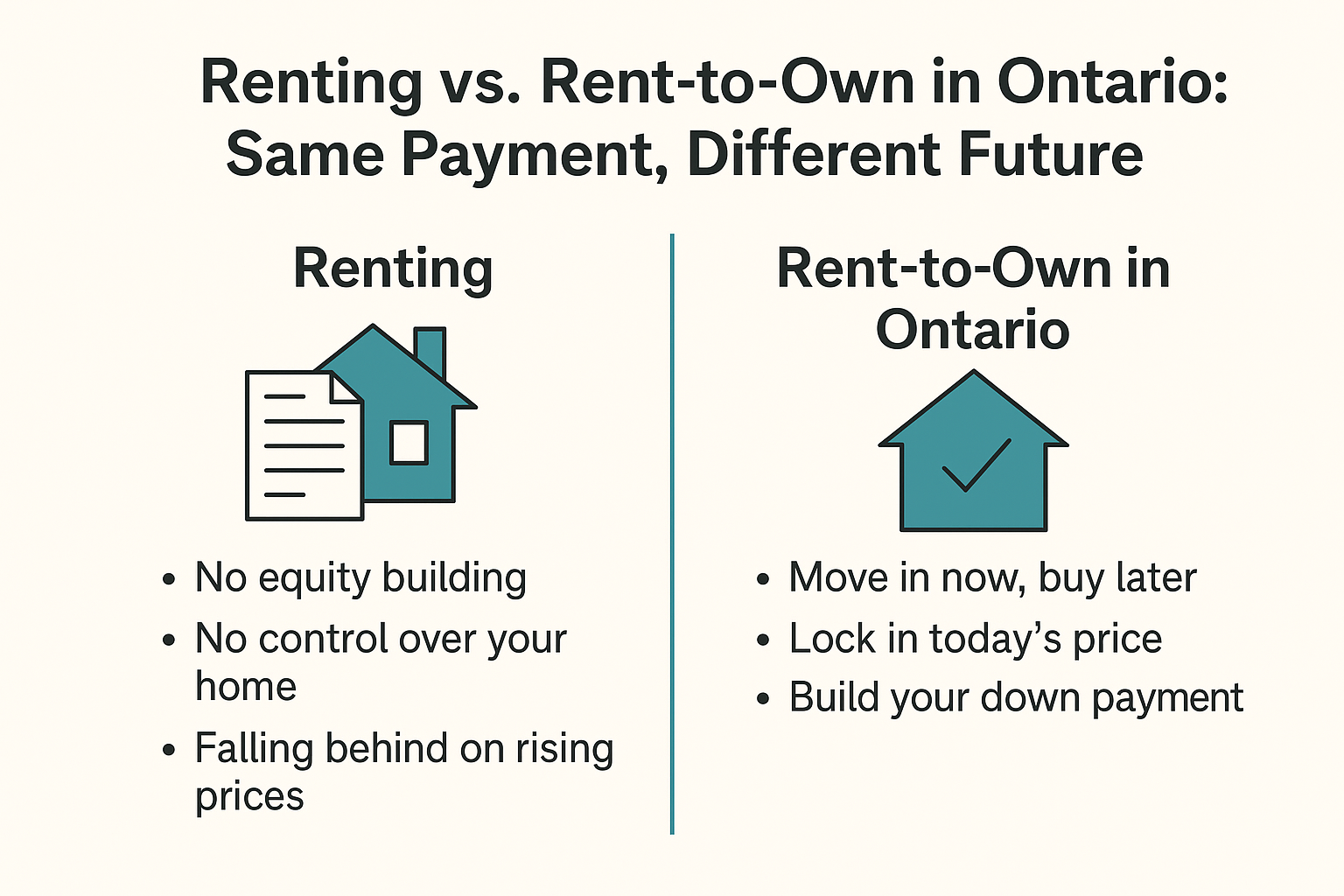

Renting vs. Rent-to-Own in Ontario: Same Payment, Different Future

When it comes to choosing between renting and rent-to-own in Ontario, many families are surprised to learn that the monthly payments are often similar. The big difference is what those payments actually do for your future.

In this blog, we’ll break down the pros and cons of renting compared to rent-to-own, and why more Ontario homebuyers are making the switch.

The Cons of Renting in Ontario

Renting may feel easy in the short term, but it comes with long-term challenges:

-

No equity building: Every dollar you pay goes straight to your landlord and I don’t know any landlord who is willing to share the equity they have in their home with a renter. May renters get caught up in the renting habit where they just settle into something that is comfortable for them without really realizing how it will impact their security or financial future.

-

No control over your home: Landlords can sell, raise rent, or make rules that limit your freedom. I spoke to one family where they investigate rent-to-own but decided that their landlord was just too good to them so decided to keep renting until the landlord, not more than 3-months later, asked them to leave because he was selling. Loyalty isn’t always a two way street.

-

Falling behind on rising prices: Home values in Ontario have historically increased by 4–6% annually. Renters miss out on this growth. On the other side, when prices are decreasing in some areas like today, there is room to buy for less than in a good market. These “good” markets don’t last forever and some renters make the decision to get into ownership too late and end up missing out on the deals that are in a market like today.

In short, renting is a dead end for most families that want to set down roots and leave a legacy for their family.

The Pros of Rent-to-Own in Ontario

With rent-to-own, the same monthly payment becomes a launch pad to homeownership for many families:

-

Move in now, buy later: Live in the home you’ll one day own while preparing for mortgage approval. Treat it like your own where you can renovate and add value to the property which could result in more equity in the future.

-

Lock in today’s price: Protect yourself from rising Ontario home prices by securing a purchase price upfront. All numbers are set at the beginning of the term so no surprises.

-

Build your down payment: $400–$600 of your monthly payment is credited toward your future down payment for paying on-time each month. That’s right, you are already doing it in your rental, so why not benefit from paying on time in a home that you want to eventually own.

-

No upfront closing costs: Unlike a traditional purchase, you don’t need thousands in closing costs on day one and will have the entire rent-to-own term to save the closing costs.

Rent-to-own turns your monthly payment into a smart investment in your future as well as providing security and financial potential with the equity in the home.

Why Rent-to-Own Makes Sense in Ontario’s Market

Ontario homebuyers are facing stricter mortgage rules, higher interest rates, and the challenge of saving a 10% down payment while paying rent. Rent-to-own bridges the gap:

-

You only need about 5% saved to get started.

-

You gain the security of homeownership without waiting years to save more.

-

You position yourself for mortgage approval while living in your home.

For many families, rent-to-own is the only realistic path to buying a home in Ontario’s competitive market.

Final Thoughts

Both renting and rent-to-own require a monthly payment. But only one puts you on the path to financial stability, equity growth, and true homeownership.

Want to know how the payments are calculated?

Want to find out more about rent-to-own?

Leave A Comment