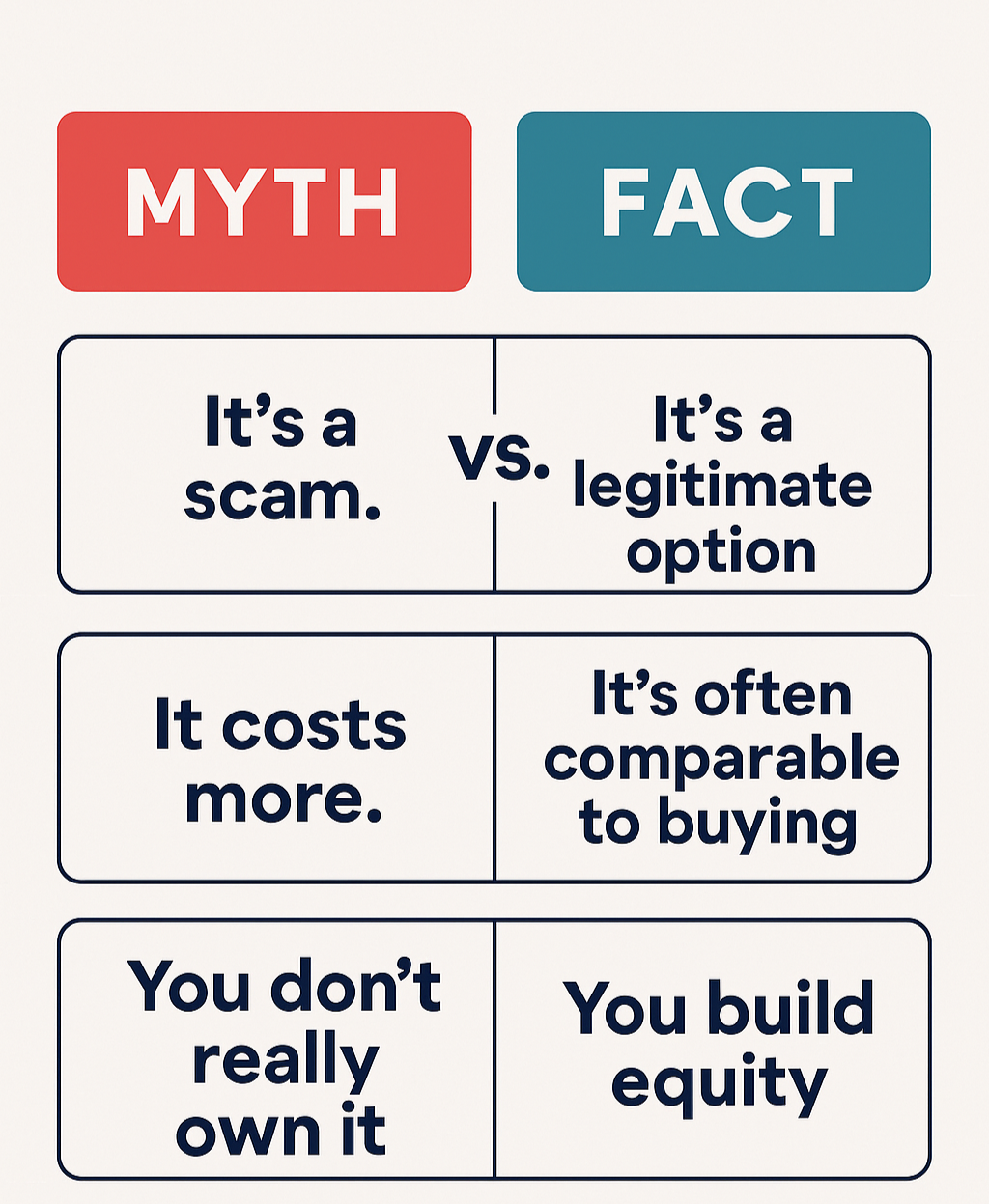

7 Rent-to-Own Myths That Could Be Stopping You

If you’ve been dreaming of owning a home but can’t get a mortgage right now, you’ve probably heard about Rent-to-Own. You’ve also probably heard a lot of mixed opinions—some of them flat-out wrong. In this blog, we investigate the 7 Rent-to-Own myths and help debunk them.

The truth? Rent-to-Own is a legitimate, structured path to homeownership for people who have the income but need time to build their credit or save a bigger down payment. These myths tend to come from family or friends who “heard” something about rent-to-own and needed to pass it on – even if it was incorrect.

1. “Rent-to-Own is a scam”

Yes, there are bad actors in every industry—but that doesn’t mean the whole system is broken. Legitimate Rent-to-Own programs in Canada:

-

Use legal agreements reviewed by lawyers

-

Outline all terms upfront, including the locked-in purchase price

-

Provide a clear plan to get mortgage-ready

Tip: Always work with a reputable company that encourages you to have your own lawyer review the contract.

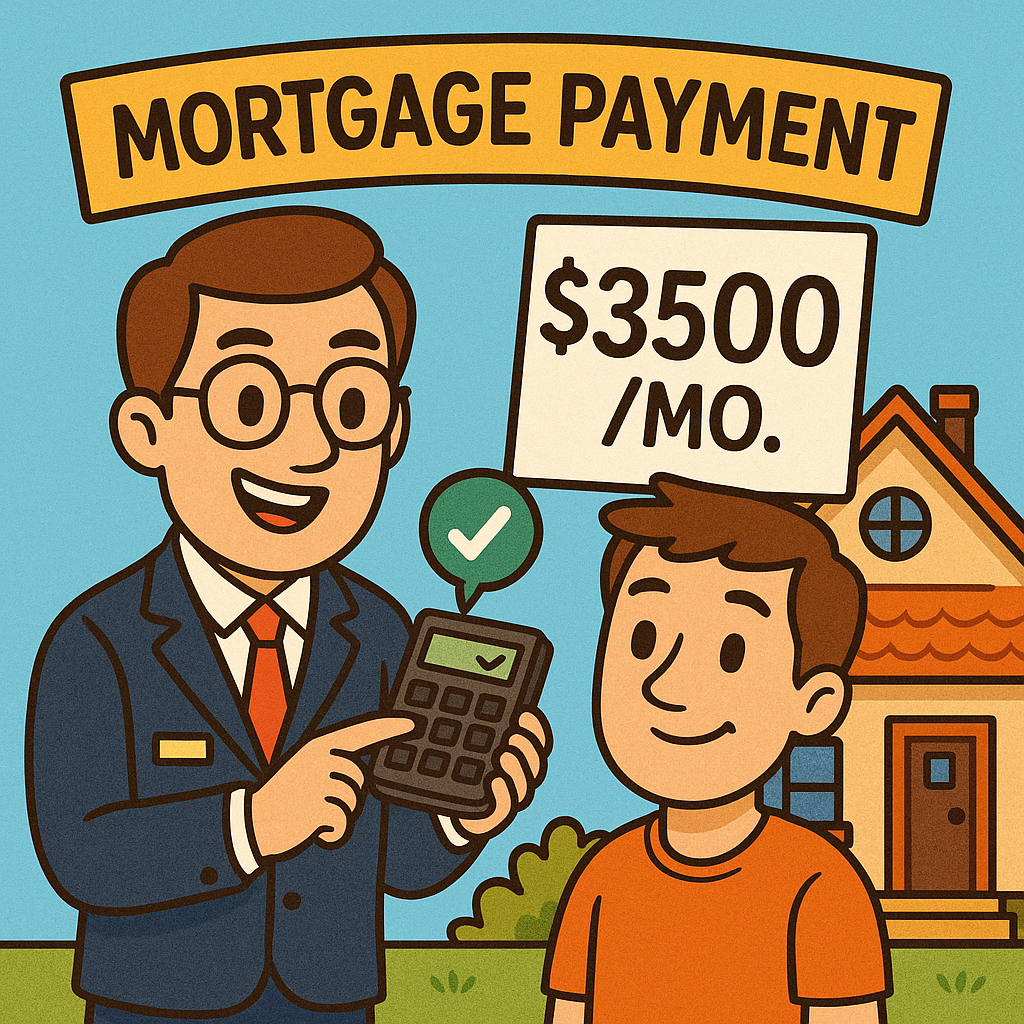

2. “It costs way more than buying a home normally”

Your monthly payment in Rent-to-Own is designed to be similar to a mortgage payment—but with a twist:

-

A portion of your payment (often $400–$600) is credited back to grow your down payment just for paying on-time.

-

You avoid immediate closing costs like land transfer tax until you officially buy

That means you’re building equity while living in your future home—not throwing money away on rent.

3. “You don’t really own the home”

True—you won’t legally own it until the end of the Rent-to-Own term. But here’s the difference:

-

You’ve locked in the purchase price

-

You control the home as if it’s yours (within agreed terms)

-

You’re building equity toward your ownership

Think of it as buying on a timeline—you move in now, and the keys are already waiting for you at the finish line.

4. “It’s just like renting”

Not even close. With traditional renting:

-

Your payment disappears into your landlord’s pocket

-

The landlord can sell or ask you to move at any time

With Rent-to-Own:

-

You have security knowing the home is reserved for you

-

Your payments are building your future down payment

-

You get time to improve credit, reduce debt, and get mortgage-ready

5. “The purchase price might change”

Not in a properly structured program. In Rent-to-Own, the purchase price is agreed upon at the start and written into your contract. Even if the market goes up 20% over 3 years, your price stays the same—protecting you from getting priced out.

6. “You have to have perfect credit to qualify”

This is exactly why Rent-to-Own exists—you don’t need perfect credit today. You just need:

-

Stable income (e.g., $100K household income or more)

-

A reasonable down payment (often 5% of the home price)

-

A willingness to follow the plan to improve your credit during the program

7. “If I can’t get a mortgage at the end, I lose everything”

Yes, if you don’t complete the purchase, you may lose the credits you’ve built—but that’s why reputable programs offer support every step of the way:

-

Budget coaching

-

Mortgage preparation check-ins

-

Clear timelines so you’re not caught off guard

The goal is always to make sure you’re ready before the end of the term but the work required to get there is on you to complete.

Final Thoughts

Don’t let misinformation keep you stuck renting. A legitimate Rent-to-Own program can help you lock in your future home, build equity while you live there, and get mortgage-ready—without waiting years on the sidelines. Find out why it’s a good idea for Canadians looking to get into homeownership.

Ready to see if Rent-to-Own could work for you?

Find out what you could afford today and take the first step toward homeownership.

Leave A Comment