Boost Your Commissions With Rent to Own

Have you ever lost a deal because your client’s financing fell through?

Then you would know how frustrating it can be. It’s not just a question of how much time and energy was spent searching for the perfect house for your clients. For many realtors it is also an emotional disappointment because they won’t have the satisfaction of helping some families get the home they have their heart set on.

What if there was a way to help more homebuyers?

We are dedicated to helping people realize their dream of homeownership. That’s all we do. We have a solid track record and many success stories to share since 2010. Our rent to own program is customized for your client’s needs. Once size does not fit all. During the pre-arranged rental term, homebuyers typically receive professional support to build up a bigger down payment or increase their credit score to qualify for a mortgage within 36 months.

What makes our rent to own program so successful? We have a team of experts dedicated to helping homebuyers cross the finish line. Our homebuyers also benefit from fair market prices and can cash in on equity-building opportunities that don’t exist if they continue to rent.

How Rent to Own Can Help Your Clients

Pay a fair future purchase price – We don’t hike up appreciation rates to set our future purchase price. We take a comprehensive look at the market and work on a market by market basis which averages out around 3.5% – 4.5%.

A big reason that rent to owns fall short is that they don’t help the client save a big enough down payment. Our program is geared to getting your clients to 8.5% – 10% down by the end of the rent to own program. We understand how hard it is to save and don’t put the onus on your clients to “make up the difference” on their own.

Credit is one of the words that has most of your clients shaking their heads. Many don’t understand how credit impacts their lives (or how their misuse of credit has put a strain on their freedom to own a home). As part of our rent to own program, your clients will work with our financial specialists to not only understand their credit situation but take meaningful steps to correct it.

Your clients have equity in their home from the day they move in (in the form of their down payment). One of the best things about rent to own is that your clients can help themselves by building additional equity into their home through upgrades and renovations. How much equity can they build in a rental?

What Does This Mean For You?

Who would be a good fit for rent to own?

Is your client divorced? Self-Employed? New to the country? Less than 5% down? Bruised credit? Working their way back from a bankruptcy or consumer proposal? So what qualifications must your clients have to be considered for our rent to own program?

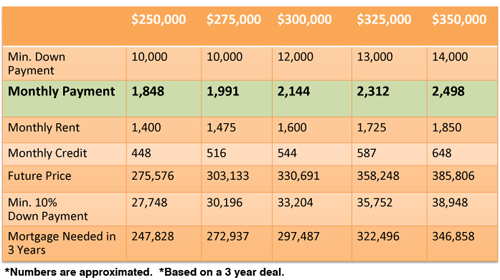

The Numbers

There are 4 key factors that will affect the amount of monthly payment your client can expect to pay in our rent to own program. Here is a breakdown of each of the factors::

Here’s Our Process

We prefer to start with a phone call to provide information on our rent to own program and answer any questions you clients may have. Best way to set this up is to have you do an email introduction to your client so they know we will be calling. Once we have spoken, we would set up a face-to-face meeting. You are welcome to attend both.

We use employment letters, two current paystubs, N4, NOA for income verification which will determine the budget. For self-employed, we can use three months of bank statements, NOA and/or invoices. We also require your clients credit reports which will help us determine the length of the rent to own term + a copy of their drivers license to verify identity. We cannot start looking at homes without this information.

Once we have all the required documentation, we will set a budget and pass the clients back to you to start looking. We will send an email to you, copying the clients on the proposed budget to ensure that there is no confusion. Once a home has been found, the listing should be sent to me so I can run the numbers on it and get an approval from your clients before we bring in an investor to work on getting the offer in on the property. If your clients have not approved the numbers, we will not move forward with an investor or offer.

Now that your clients have approved the numbers, will introduce you to an investor who will work with you to secure the property. We require inspection clause and usually 5 days for financing (although this could differ from investor to investor). We do not move forward without an inspection. The inspection will be your clients cost so please be sure to let them know. Your clients will be putting the deposit down on the property once we have an accepted offer. This deposit will become your clients down payment credit in our program if we firm up the offer and begin the rent to own.

Rent to Own Application